This week’s project in the Organized Life Series is to get your finances in order. Does it sometimes seem like your money just runs through your fingers? Do you occasionally get overdraft fees because you forgot about something that was automatically coming out of your account? Have you ever created a budget and then followed it?

By the end of the week, you’ll have a proper budget and know how to execute it. You’ll have a plan for paying everything on time and see if you can knock down some debt. You will understand some different types of banks and checking accounts available and decide how to use those to your advantage.

The Budget

You can’t do anything to improve your finances until you know where your money is coming from and where it’s going. And you have to make a plan so there’s more coming in than going out. First let me start with a disclaimer. I’ve been listening to Dave Ramsey for YEARS. A lot of my processes and thoughts come from him. Of course, what he says is all common sense. But he does have things organized into a system for getting out of debt and being prosperous. Using his system, I have paid off $55,000 in debt and now only have a mortgage and student loan debt. I have also taken a few nice vacations and done tens of thousands of dollars in work on my home. If you’re interested, I STRONGLY recommend you look into his system. You can get the basics by listening to his free radio show. You can pick up his book at the library for free. He does sell some packages, classes, and such. But back to our project!

You need a budget. You know you do.

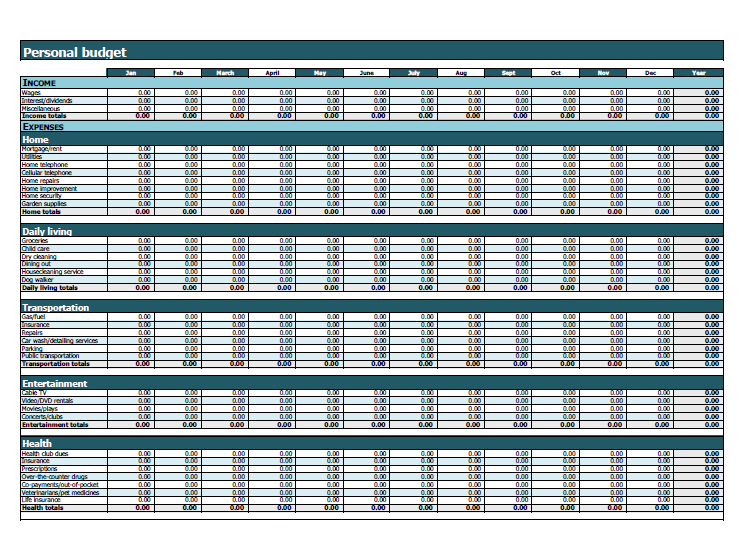

#1 - Download the Template

This Budget Template can be used or shared. This template has a comprehensive but not exhaustive list of incomes and expenses. As with any Excel Spreadsheet, you can add more rows whenever you like, but make sure the totals work out.

You may notice that this template is for a year. The reason for this is that your budget can and should vary throughout the year. You travel more in the summer and around Christmas. You need to plan for more gas. There are school clothes to buy in the summer/fall. And on and on. For this reason, you should make a budget for the upcoming month EVERY MONTH. And the total at the bottom should be ZERO! If you have money left over at the end of the month and just leave it sitting there it will magically disappear. Make a plan and stick to it.

#2 - First Draft the Budget

Whether you’re using the template or just have a spiral notebook, the plan is the same.

- Income Write down all of your income. For every job. For child support. For that planned garage sale. For your tax refund. Birthday money. If you have money coming into your household budget in the upcoming month, write it down and total it.

- Regular Expenses Write down all of your regular expenses. You probably have this list already. If not, get out the checkbook, the bank statement, your Quicken account or whatever. Start with your planned expenses. You pay the electric bill every month. You put gas in your car every month. You buy groceries. If it’s something you do every month, write it down.

- Irregular Expenses Write down all of your irregular expenses on a separate sheet. Your insurance. Your car registration. Summer school shopping. Christmas shopping. These things come at the same time every year, so plan for them.

- Convert Irregular to Regular Break down irregular expenses and make them monthly expenses. If your car tax and registration is $120 a year, budget $10 a month. Write that on your expenses page.

- Short Term Savings Write down your short term savings goals (less than 5years). Will you need a new car soon? Is your kitchen table on its last leg? Will your house need a new hot water heater or roof soon? Plan to save for these items rather than emptying your emergency savings.

- Emergency Savings Plan your emergency savings. If you’re not very solvent and/or have a lot of debt, you need a small emergency fund. Dave Ramsey (my hero?!?) recommends that you have a “Baby” Emergency Fund. A real emergency fund is enough money to cover all of your expenses if you couldn’t work for 3-6 months. A Baby emergency fund is $1,000. Everyone should have $1,000 in the bank set aside for emergencies. To pay deductibles. To fix a fender bender. To fix your radiator. You get the idea. Life is a lot less stressful if you have $1,000 in the bank.

- Total Your Expenses If you’re in the black (you make more than you spend), great! You can apply that surplus to savings or paying something off early. If you’re in red (you don’t make enough money every month to pay the bills) you will need to make some changes. You need to make more money, cut expenses, or both. Be realistic. You can’t live off $200 a month in groceries unless you want to be malnourished and helping friends move for free pizza. Consider getting a temporary second job to pay something off or reach a goal. For many, many years I worked 2-3 jobs. (How do you think I paid off $55,000 in debt?) Now I’m down to just the one job. Working extra won’t kill you. Probably. There could be an unfortunate fork lift incident. But you can do it for a year or two. However, that should not be your long term plan. You don’t want to be working multiple jobs in 10 or 20 years!

Dust yourself off and put the budget away for a bit.

#3 - Second Draft of the Budget

The second draft of the budget will become the actual working copy. The steps for the second draft will depend on whether or not you’re single. Do you have a significant other? Their opinions should count. Although you’re a brilliant person (you are reading this article, after all!) your priorities might not be the same as theirs. You may have completely different opinions on how much money should be spent on groceries, entertainment, or clothing. For those WITH significant others, here is the process:

- Begin budget committee meeting. During the budget committee meeting, you meet in an agreed-upon neutral place at an agreed-upon time. There are no distractions. You hand the budget over to your partner and let them read the whole thing and maybe even jot down some concerns before either of you discuss it.

- Listen. Your partner gets to voice their concerns. Even if they are completely irrational and they want to be able to spend $500 more a month than you make, listen to what they really care about. Are they worried that you’re trying to control them? Are they worried that they’ll be working when they want to be home to start a family? Are they worried you want THEM to get a second job and have no life while you buy the stuff you want? Get to the heart of the real issue. Remember that fights about money are the biggest cause for divorce in North America. (Or so I’ve heard.)

- Communicate and Compromise. You’ve listened to their concerns. Discuss them and your take on them. Discuss your concerns. Maybe you’re worried that your lifestyle is outpacing your income. Maybe you’re worried that one of you won’t be able to stay home with the kids. Maybe you’re worried that you’ll never be able to retire.

- Talk about mutual long term goals. Financially, where do you want to be in 5 years? Do you want to be debt free except for the house? Do you want to pay $31,000 for that $25,000 car that will be worth $10,000 when it’s paid for? Do you want to have a 6-month emergency fund and be able to afford a nice vacation in 5 years? What’s important to you as a family? Then discuss what you’re willing to sacrifice now to meet that goal later.

- Be realistic. Your partner loves that morning stop at the coffee shop. You like your iTunes app downloads. Each of you should have a slush fund of money you can blow on whatever you like. It may be $20 a month. It may be more. But it’s for pocket money for things outside the budget.

- Final Budget. Write up the final budget that you both agree on. That piece of paper is now a financial contract between the two of you. Nobody buys anything outside that budget unless you come back to the table and have another budget committee meeting. If you need to spend over $50 in one category, then another category has to be reduced. You’re not Congress. The budget has to balance.

What if you’re single? You can make a decision anytime to do whatever you want and only YOU have to live with the consequences. Unfortunately, you have no accountability. If you’re a diciplined person, you can work through it. If you’re not, get an accountability partner. It could be a friend or family member. Get someone you trust to call you on your crap. Someone you don’t mind knowing how much money you make unless you want to edit the budget before showing them. If you don’t have an accountability partner you’ll need to find some way to hold yourself responsible. Use a rewards system. Write down your goals so you can see what messing up the budget will cost you. Here is the Second Draft process for you:

- Write down your long term goals. Financially, where do you want to be in 5 years? Do you want to be debt free except for the house? Do you want to pay $31,000 for that $25,000 car that will be worth $10,000 when it’s paid for? Your friend is getting married in Hawaii next year and you really want to go. You just realized that you’re paying 25% interest on a credit card and you’re sick of it. Think about what you’re willing to sacrifice now to meet those goals later.

- Adjust the budget. With those long term goals in mind, adjust the budget. If you cancel the cable maybe you’ll be able to write that novel. It saves money and helps meet a goal. Maybe you’re willing to get a second job for a purpose. You’ll pack your lunch and only eat out once a week.

- Get accountable for those goals. At least take your goals to a friend or family member and post them where you can be reminded. If you can, have your friend or family member sit down and go over the budget with you. This will make you think twice before you “cheat” on the budget.

- Write up the final budget. You control the budget up to this point, but after that, you must stay within the rules you set for yourself.

#4 - Executing the Budget

The first month you try to live with your new budget, you’ll realize you didn’t have as much of a clue about your finances as you thought. A birthday party will come up you didn’t plan for. Or any other of hundreds of unplanned expenses. At that point you go back to the table and adjust. That $20 you had to spend must come from somewhere. Now you won’t be able to do X.

Adjust, Execute, Adjust, Execute, rinse and repeat. This will go on for a few months before you finally nail it down.

I can’t emphasize enough that you should KEEP GOOD RECORDS of your spending. You should not have a $600 cash budget to buy groceries, eat out, etc. Everything should have a category if you do it regularly. Your slush fund to blow is for a bag of chips, or grabbing a magazine. Little fun stuff that doesn’t have a category because it’s not regular spending.

A good tip is to make envelopes for everything you can pay cash for. Dining out, clothing, groceries, etc. Anytime you can walk into a store to purchase something, have an envelope for it. It’s easier to keep track of how much money you have left. You can do this weekly or monthly. Go to the bank Monday morning or Friday afternoon and fill the envelopes. It’s easy to run to the grocery and spend $120 here, $30 there and end up $50 over budget because you don’t have time to check it before you go buy bread, milk, and cereal. But if you have an envelope and walk into the store knowing you have to get your groceries for the amount of money you have in your hand, you’ll pay more attention to what things cost and you’ll stay on budget.

It will take a few months to get your budget under control, but the basics won’t change: Rent/Mortgage, loan payments, utilities, groceries, other things like that are pretty easy to plan for.

Banking

#1 - Know What to Avoid in a Bank

If you haven’t been paying attention to your bank lately, you should. Many national and local banks have recently added a lot of small “gotcha” fees to their “free checking”. Find out if your bank charges for the following fees:

- Maintenance Fee – your free checking may be about to change

- Minimum Balance Fee – you may have to keep a balance of $1000 or more to avoid paying maintenance fees.

- Transfer Fees – you can avoid overdraft fees by attaching a savings account to your checking. If they have to move the money automatically to cover something, there’s a fee

- Deposit Fees – you can be charged if you make too many deposits in a month. Really?

- Bank Card Fees – you can be charged if you use your card more than X times in a month

- Transaction Fees – you can be charged if you use your ACCOUNT more than X times in a month

- Online Bill Pay Fees – some banks charge fees for sending checks through online billpay

- Overseas Transaction Fees – most banks charge a percentage fee if you use your card overseas. Beware! This can apply to some online companies.

- Inactivity Fee – use it or lose it

- Research Fee – when you make requests that require research to resolve, banks may charge you an hourly fee for conducting this research.

- Debit Card Replacement Fee – lose it, abuse it

- Credit Card Funding Fee – if you transfer money from a credit card line into your checking account, there could be a fee.

Something else to be aware of – how long will it take to transfer money across your savings/checking, or from linked external accounts?

I had used the same local bank since my first year of college (eons ago, yes). Last year they sent out a letter that their free checking was only free if you kept a minimum balance of $500 OR had more than $5,000 in savings attached to that checking account. Online billing would start costing money. There was a fee if you made more than so many debit card purchases, and on and on. I left that bank and went to a credit union where free checking was still free.

#2 - Know What to Look For in a Bank

Some banks do things really well and some are a mixture of the two. Here are some services you should check for in a bank, including some that you may not have been aware of:

- Free checking with no required minimum balance or fee.

- Free online billpay

- Interest-paying checking accounts

- Rewards checking accounts

- Automatic Savings Plans – you can set up money to automatically transfer between accounts, even external ones.

- Will that bank work with your personal finance software?

- Is there an app for that? Hey – some people care.

#3 - Local or Online Banking?

As a disclaimer, I have used ING Direct online banking for about 5 years now with no trouble. I have used PerkStreet for over 2 years. I also use a local credit union.

Why Online?

You have a bank just down the street. You like it. They aren’t ripping you off with hokey fees. Why would you consider an online bank?

Interest

If you have any money in the bank and would like it to be earning interest, you should look into ING Direct. This is a highly reputable bank that is currently paying 0.2% interest on checking accounts and 0.8% on savings accounts. These are free accounts. For reference, a savings account at my local bank is currently paying 0.1%. ING Direct is paying 8x more for savings. If you have your $1,000 Baby Emergency fund sitting in ING, you would be making $70 more a year with ING than your local bank. Well, at least the lousy local bank that I left.

Perks

There’s a bank called PerkStreet that is also a very reputable bank. Earn up to 2% cash back on every purchase – almost anywhere you use your card – with 5% PowerPerks categories. The minimum you will get on EVERY purchase is 1%. See the Perks Earning Rates.

Why Local?

If the online banks are so great, why use a local bank? That’s easy. Do you often receive paper checks that you need to run down to the bank to deposit? To get them to the online banks, you have to mail them. They give you free envelopes, it just takes extra time to get things deposited. Do you withdraw cash weekly or monthly for your envelopes? (you should) It’s easy at a local bank. However, at either bank you can make cash withdrawals with your card at an ATM machine. Just be aware of the network you’re on so that you don’t get charged.

Can I Have More Than One Bank?

Absolutely. Here’s how I use 3 banks:

- Local Credit Union

- Direct Deposit from work

- Cash withdrawals for envelope system

- Billpay – to utility companies and local water delivery

- Check writing – for school stuff for the kids

- Check and cash deposits

- ING Direct

- Automatically deduct half my mortgage from the credit union the day after paycheck deposit. My mortgage company autodrafts the payment from that savings account. If they go nuts and withdraw twice, there’s nothing to get. My checking account won’t be overdrawn. Also, that money is sitting there earning interest.

- Pool savings for irregular expenses and earn interest. You need to save for things like car tax and registration or annual insurance premiums.

- Short Term Savings. You need somewhere to keep your money if you’re saving for something less than 5 years away. It’s too volatile to put in the stock market. So money for a car, furniture, a vacation, or other items needs to go somewhere it can earn interest.

- Perk Street

- Use this for planned spending so that you can earn rewards on your spending. Things like Gas, Groceries, Netflix, etc which are budgeted and predictable.

- Use this account for shopping on Amazon. Extra rewards

Do It!

Now use everything you’ve learned to develop your own banking strategy.

Money Management System

You need to have some method of managing your money, bills, and accounts. If you don’t, you won’t catch double-charge errors. You won’t catch errors at all and this will cost you money. Additionally, you are probably bouncing checks occasionally due to your own errors. You need a system! This system could range from a paper checkbook register to running Quicken on your computer, to using an online money management system. Let’s walk through those options.

Paper Management

This is how we did it in the old days. Your checkbook came with a register. You wrote each of your transactions in the register and when you got your statement each month, you went through and saw which items cleared. You then totaled the items that had not cleared and made sure your balance matched the bank. This was a very time-consuming method and is considerably outdated.

That said, everyone should do this for a couple of months so that they understand fully how to balance a checkbook. When my 14 year-old got a job and opened her first checking account, this is the method I made her use for a few months. Understand the importance of learning to do something manually so that you understand the way the system works.

If this is the system you’re comfortable with, try stepping out of the box. You’ll save yourself a lot of time.

Quicken or Another System NOT ONLINE

If you’re someone that is not comfortable with having your financial details out there on the internet, this is the system for you. You can run Quicken on your computer and set it up so that it NEVER accesses the internet.

The advantages to this system over straight paper management is that some things become automated. You enter your ending balance from your last statement. You enter all of the transactions that have not cleared. Then, next month when your statement comes in you check items that cleared and enter your new ending balance. Quicken tells you if there’s any problem and you get a reconciliation statement. The system gets more and more efficient as you use it. You pay some of the same bills every month, like your electric bill. The first time you enter that payment, you will choose a category (like Utilities) and any notes. The next time you go to use it, Quicken automatically fills in the same information as the last payment. You can just tab over and change the amount and press enter.

This method is quicker than doing it manually on paper and slower than using Quicken along with online statement retrieval. My 100 year-old grandfather used this method for 10 years. He liked the simplicity compared to a paper register, the computer was better on his poor eyesight, but he didn’t want his stuff online.

Quicken with Automatic Bank Downloads

The next level is using the same Quicken system except instead of using paper statements, you connect to your bank’s online system and download the statement information automatically. These are secure online transactions and people have been doing this for years with no problems. The advantage is that you don’t have to type in your transactions. You can get them all automatically, then just click through and fix them if they’re not in the correct category. It remembers your choices and tries to improve the import process as you go.

The disadvantage here is that you do need to backup your files occasionally and you will only have access to this system on your computer. You can’t use a mobile phone to check your balance.

This is the system I had my daughter use for about 3 years. I wasn’t comfortable with her having access to things on her phone. She lost it a lot.

Online Money Management System

This is my recommendation for many reasons. First, it’s free. Second, it’s easy. Third, you not only get account management tools, but there are great budgeting, investment, and savings tools as well. Lifehacker had their users recommend the best money management systems and here are the responses and my opinions:

- Mint (84.5% recommended) – This is what I use and what my daughter uses as an adult. Everything works most of the time. Occasionally, my local bank does something to break the communication with Mint and it takes about a week to get it up and going. Mint has great graphics, is very user-friendly, and has awesome iPhone/Android apps.

- Yodlee (5.4% recommended) – I tried this and had a lot of problems getting my accounts to sync, which is strange since Yodlee is the background DB for Mint. This is a more bare-bones site.

- Buxfer (5.1% recommended) – I’ve never tried it

- Mvelopes (1.4% recommended) – I tried this one and just didn’t like it as well as Mint. It’s centered towards help you control spending.

- ClearCheckbook (1.0% recommended) – I’ve never even heard of this one.

Try It!

If you’re not familiar with these systems, get online and try one. Particularly Mint. If you’re still not convinced, check out my article on Using Mint.

Stick With It!

You now have a budget, a great banking setup, and are using an online money management system. Be flexible enough to make the necessary changes every month, but disciplined enough to make a budget and stick with it and balance your accounts every month. By paying attention to your money, it will stretch farther and become a tool to help you reach your goals.

You can apply the same general concepts to your small business. But I do recommend that you use a CPA to make sure you’re doing things correctly with your taxes.