You’ve been organizing your Finances as part of the Organized Life Series and you’re ready to start using Mint. Great! Mint is a wonderful tool. Just to be clear, I am in no way affiliated with Mint, Intuit, or anything else. I just like most of what Mint allows me to do and I want to help others get those same benefits.

About Mint

Mint.com has over 7 million users and is a subsidiary of Intuit. Intuit is the company behind Turbotax, Quicken, and Quickbooks. Quicken used to use Yodlee for their banking connections but now uses Intuit. Mint’s main purpose is for tracking bank, credit card, investment, and loan transactions and balances. The user interface (UI) is bright and graphical, but clean. Mint also includes tools for budgeting and savings goals. Users have the ability to import transactions up to 30 days in the past or enter transactions manually.

My Biggest Complaint

You can’t get many transactions from the past. You will be able to get 30 days of transactions. You might get up to 90 days. It seems that that limitation is put in place by the banks, though I am able to see transactions much further in the past in my bank’s page. That’s all fine and good, but here’s the real problem. You can’t upload transactions from Quicken. You can enter them manually one by one. But there’s no upload feature. So if you’re switching from Quicken to Mint (even though they’re owned by the same company) you won’t be able to keep your old information. So back it up and keep Quicken on your computer indefinitely.

Security

According to Mint, they are as secure as going directly through your bank’s system. I am a naturally skeptical person and did a little more research. I wanted to hear what outside specialists thought.

According to an article in the New York Times titled Should You Trust Mint.com?:

- Nothing you do online is 100% secure.

- Your data is more likely to be accessed on your computer than online.

- If someone were to completely access your Mint.com account with your username and password, they could not transfer money or write checks. They could only view your account balances (with no associated account numbers).

- Transferring data to/from Mint is as secure as accessing your online banking. It meets the standards required for financial institution encryption. It could be better by using a military-level encryption, but it’s not necessary.

The bottom line is that there’s really nothing to worry about. Do you have an account with a card attached with a company like Amazon or Apple (iTunes)? There is more potential for money coming out of your account with those accounts. If you refuse to even store or use a credit card number online, then online banking and money management may not be for you.

Cost

It’s free. No, really. It’s free!

Why is it free? They advertise banks, credit cards, and financial services through “recommendations” to help your finances. They make it super-simple to use Turbo Tax to do your taxes. And Turbo Tax is definitely NOT free.

Benefits

I’m not going to take time to walk you through how to set up your account. Mint has a wizard for all of that. Instead, I’m going to talk about how it will make your life better.

Reports

One of the biggest benefits to using money management software is to view reports.

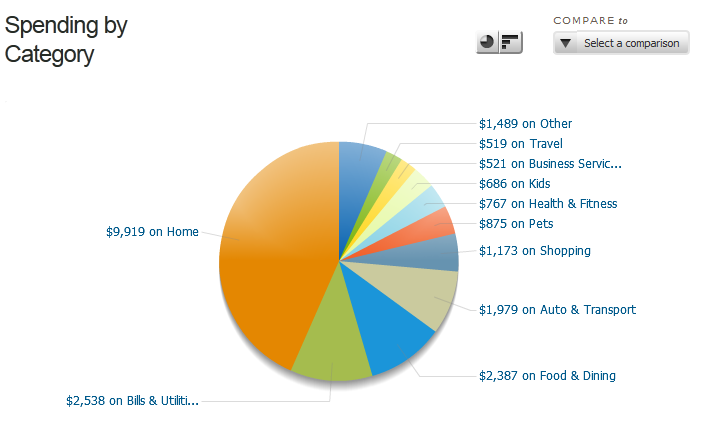

You can use Mint’s reporting tool to view your spending or income for any number of current or past months. This is my spending for the past 6 months. Man, those pets are expensive!

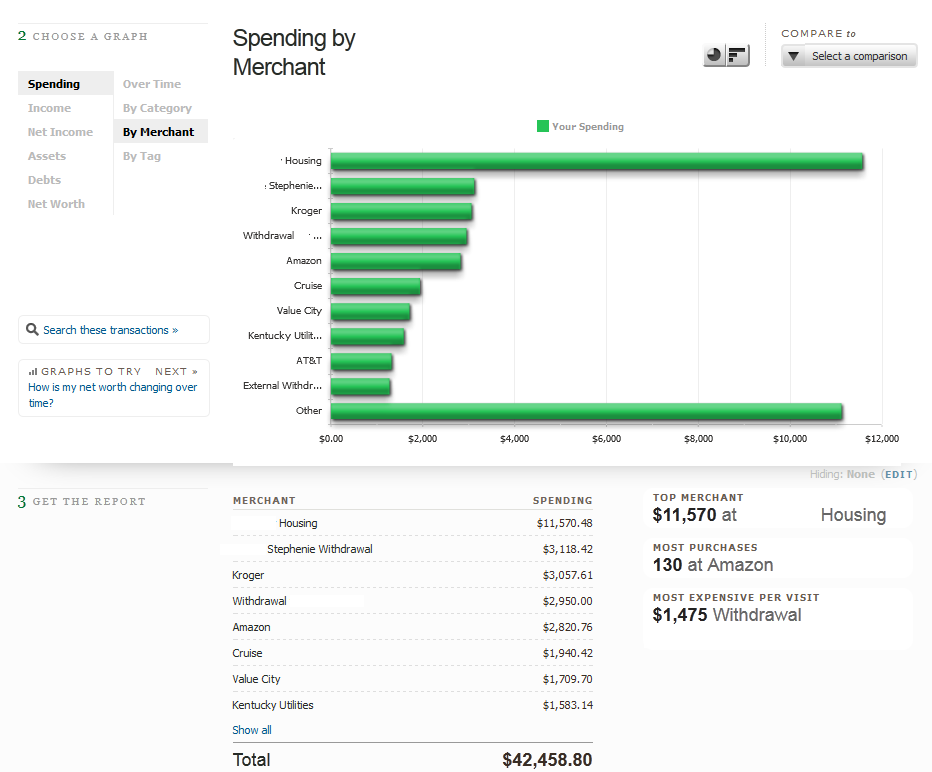

You can also view your spending by merchants:

This report is spending by merchant over the past year. Obviously my mortgage payment is the biggest expenditure, as it should be. But my Kroger (grocery) bill is $3,057. And the information at the bottom shows that I have made the most individual purchases at Amazon at a staggering 130 transaction.

Reports can help you find trends in your spending so that you can improve your system, or find ways to save money. If you saw that you had 130 transactions at Amazon, you’d make sure you were getting good cash back deals on purchases through Amazon. (Which I am!)

Budgets

In the Finances week of the Organized Life Series, you developed a budget. Mint works exceptionally well as a budgeting tool. It’s very easy to set up or edit your budget.

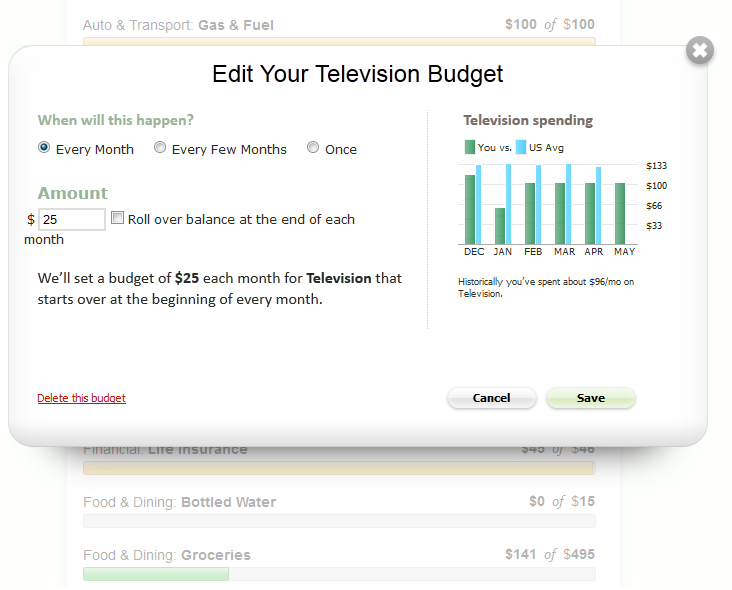

In the above example, I edited my television budget. I previously had bundled phone/internet/cable service for about $100 a month. I changed internet/phone providers and my new television budget is $25. As you can see, it’s easy to set up lump sum budgets like your vehicle registration. You can keep a rolling budget for things like gifts and entertainment so that you know the remaining balance in that category. You can even view the history of the category while setting up the budget. The budget page shows you at a glance what your budget is looking like.

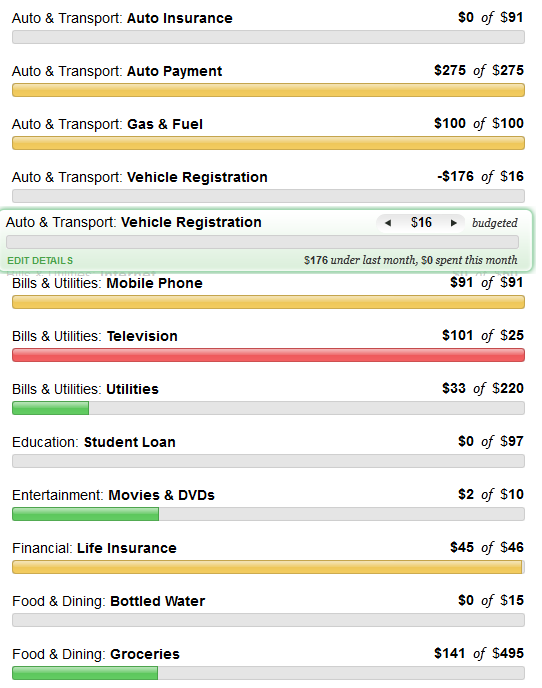

In this example, you can see the different types of budgets. Auto Payment and Gas are regular monthly expenses and all the spending for the month is complete. Vehicle registration is due at the end of this month. I’ve been saving $16 a month to pay the $190 or so registration bill. Mousing over the category shows the colored pop-up. It shows the rollover from the previous month. The red bar means I’m over budget.

Using the Mint.com budgeting tools can help you understand where your money is going and to plan for and control your spending.

Goals

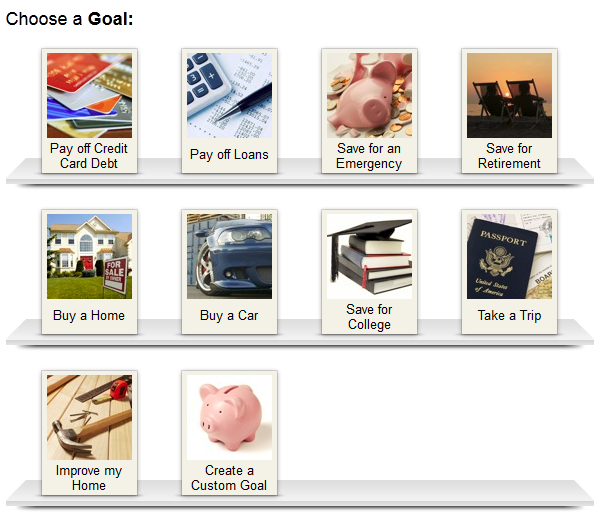

Mint has a great set of tools for planning and goals.

The tools walk you through a great little wizard and help you to plan to reach your goals. I don’t need to say much about these other than you should use them and they’re handy.

Overview

The overview page helps you see the big picture once you’ve entered all of your accounts. Do you have a lot of debt? Are you on track for retirement? What’s your net worth? How is your budget looking for the month? Do you have any bills due? There are alerts that you can set for high spending or low account balances.

Conclusion

Mint.com has a few problems and you will probably be annoyed when one of your accounts stops syncing. But overall, it’s a strong tool to help you manage your finances and budget quickly and easily and has great reports to visualize your data.

You can use Mint for your small business. However, do look into Quickbooks so that as your business grows you are able to scale with it. There will come a time that Mint won’t be enough and you’ll need to pay for a professional solution.