This week in the Organized Life Series, we will be organizing our Life Papers. These types of papers serve two purposes. They are your official life records necessary for other official life purposes – like your social security card and birth certificate. And they are all of the papers that someone would need if you were dead or gravely ill.

If something happened to you, would someone know where to get your life insurance papers? Would they know how to pay your bills? How would they know what businesses and debtors to contact? Would they even know that you want them to if they’re not your spouse? It is IMPERATIVE that you take a little time and prepare a file with all of the important information for your loved ones. And that you let them know how to access it if it becomes necessary.

We’re going to organize everything that we can in Google Drive (Google Docs) because they provide more secure storage than Drobpox. Things that must have a physical presence will have instructions in our documents.

Document Storage - you need a safe!

- Birth Certificates

- Social Security Cards

- Passports

- Marriage Certificates

- Home mortgage / deed documents

- Contracts (like an apartment lease)

- Insurance Paperwork including your car, home, and life insurance policies

- Last Will & Testament

- Important financial or legal records

- Medical Records

- Credit Cards that you don’t use every day

- Coins, Jewelry, other valuables

- Guns – to protect children and protect from theft

- Software and Data Backups – although if you did your Backups as recommended in this series, this isn’t necessary.

What’s important in a safe? There are two major events you want to protect your valuables from. Theft and fire. There are ratings for safes for both of these events. A good burglar-proof safe could cost you thousands of dollars. They will protect you from serious, professional thieves. Most of us don’t need to worry about that. The bigger concern is Fire safety. Safes seem to start at about a 1/2 hour fire rating, which is sufficient for most single-family homes. If you want to invest in a better safe, by all means – do so! But here’s the safe that I chose for myself:

SentrySafe H4100 FIRE-SAFE Waterproof File, 1175 Cubic Inches – $59 new

I purchased this safe many, many years ago and am very happy with the size and key-accessibility. I have one key hidden in my house and my estate executor has the backup key. For my daughter’s safe, she has one key and her backup key is in my safe.

A safe can be very economical, but if you choose not to use a safe, please consider going to your bank and getting a safe deposit box.

You need a will!

If you are an adult with any assets or property you need a will. In the U.S., wills need to be state-specific. So if you got a will years ago in one state, it may not work as you expect if you live in another state now. Here’s my advice:

- If you have any complexities to your estate, get a lawyer. You can get quotes and shop it around, but a decent will will cost you a few hundred dollars. This is a good idea if you have assets or a large life insurance policy and underage children. Do you want them inheriting hundreds of thousands of dollars when they turn 18? Probably not. I set up my estate so that my executor handles the money and pays for things like school, cars, or such at the trustee’s discretion. When my daughter turns 25, the executor can release anywhere from 33% of the money to 100%, depending on the level of responsibility of my child. At the age of 35 she gets it all. I also set up my estate so that my ex husband could buy my home for the mortgage balance if my daughter were still underage at the time of my death. This would allow her to stay in the same school district. Those are some examples. Maybe you want to leave everything to one child and the other gets nothing. If your will isn’t straightforward, get a lawyer.

- If you have a simple will, you can make your own will. Go to USLegal and get the Dave Ramsey Special. That’s currently $15 for a will. Make sure you get the will for your state. This option is good for singles, married couples with and without children, divorcees, widows, and more. Have a look and see if it fits your needs. (I don’t get any referral or anything.)

Create a Master Kit

I first heard this recommendation around a year ago on Lifehacker and immediately set one up. Just in case that zip file is no longer available, you can download it here.

A master kit is a go-to document that you’re leaving for those you love if something happens to you. In order to prepare the kit, you will need to:

- Download the Master Kit

- Gather your personal records

- Online Accounts

- Funeral Planning

- Personal Questions – download here or Personal Letters

#1 – Download the Master Kit

The Master Kit from Lifehacker can be downloaded here. This is a zip file containing PDF, XLS, and ODS formats. I recommend that you immediately upload the XLS file to Google Drive (Google Docs) and work on it there. After you upload it, have a look through all of the tabs and familiarize yourself with all of the information you’ll need to gather.

#2 – Gather your personal records

Look at the earlier list of documents that need to be kept in your safe. As you gather your documents, keep in mind the categories that you will be filling out in the Master Kit.

- Identification Records: Items such as your Social Security Card, Birth Certificate and Passport should be scanned to a PDF and uploaded to Google Drive.

- Contact information: Both your contact information and your emergency contacts’ info. This includes your nearest relatives, your will executor(s), and employers.

- Will and medical directives: Add a copy of your will/living trust and medical letter of instructions (keep the originals with your legal representative). You can upload a PDF file to Google Drive for this purpose.

- Insurance: Homeowners, auto, medical, life, disability, and other insurance agents/brokers contact info and policy numbers

- Financial accounts: Bank, investment, and credit card/loan accounts information, including institution names, phone numbers, and account numbers

- Health records: Immunization records, allergies, dietary restrictions, medications, medical/surgical treatments

- Pet information: Description of each pet, vet contact information, and any important medical notes

- Property: Car information, home purchase papers/deeds, and other home inventory items.

#3 – Online Accounts

In Week #5 of the Organized Life Series, we talked about Password Organization. In that segment, you organized all of your online accounts and passwords in one place, to be accessed by one password. Do NOT add that password to this document. Instead, leave instructions for your executor to access that account. Leave a paper copy of your LastPass username and password in your safe.

#4 – Funeral Planning

If you don’t plan ahead, your family will be forced to guess what you want, and that can lead to anger and bitterness between your spouse, children, siblings, and others. Don’t do that to them. Take just a day or two and pre-plan your funeral–everything from what kind of casket you want to the songs you want played to picking your burial spot. In a time that is full of sorrow, your family will feel better because they’ll know they were able to grant you your final wishes. Take time to think about and write down the following:

- Your Body: Do you want to be cremated or buried? Do you want to donate your body to science? Are you an organ donor? What is your choice of Casket/Urn/Vault type and color? What clothing do you wish to be buried in?

- Funeral Location: Are you a member of a church? Do you have a funeral home preference? Where do you want to be buried?

- Memorial Service: Who would you like to officiate? What are your music choices? Who are your pallbearer choices? Do you have food preferences? A photo slideshow?

- Flowers and donations: How do you feel about flowers? Any special requests? Donate to a charity instead of flowers?

#5 – Personal Questions or Letters

It can be difficult to talk about some things to family members. There may be bad blood between you and one of your relatives. You may have never had the chance to tell something important to someone you love. You might even want to tell others what you’d like to be remembered for after you’re gone. That’s what makes leaving letters such a good thing. Take the time to leave personal letters for those that are important to you.

Personal questions are more of a legacy. If you have lost your grandparents consider how great it would have been to have these questions answered. They tell the story of a childhood. Of becoming an adult. Of family life. Pass this information on to your children and grandchildren. Download the personal questions here.

Share Your Records

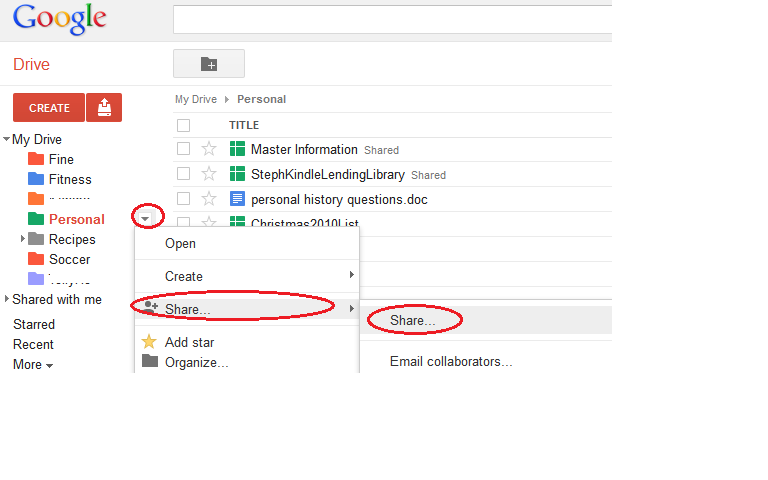

As soon as you complete your Master Kit (or sooner if it’s going to take some time), share everything that you have. Save everything to a My Drive folder and you can share the entire folder.

Click on the arrow next to the folder to share and you can email people who you want to be able to view or edit the documents. (Think people who you’d also consider emergency contacts.)

Also, if you use Dropbox, make sure you encrypt sensitive information first. An encrypted zip file seems an ideal solution.

Keep It Updated

Set up a schedule to check your files and update them regularly. If you weren’t around for Week 1 of this series, set up your calendars now!